Introduction

The ‘SEC Twitter Hack Impact’ sent shockwaves through the cryptocurrency market, as an unauthorized tweet from the SEC’s official account incorrectly signaled the approval of a Bitcoin ETF. The incident triggered a rapid increase in Bitcoin’s price, demonstrating the market’s quick reaction to regulatory news and the profound effects of misinformation.

The Tweet Heard Around the Crypto World

In an era where digital communication can instantaneously affect global markets, a single, unauthorized tweet can cause a significant stir. That’s precisely what happened when the SEC’s Twitter account was hacked, releasing a false announcement that sent the crypto community into a buying frenzy.

In a rapid response to the spread of misinformation, the official Twitter Safety account released a statement regarding the breach, emphasizing the serious nature of the incident and the actions taken. For further details on the SEC’s response to the false ETF approval announcement, see the official tweet from Twitter Safety

Immediate Market Impact and SEC’s Swift Clarification

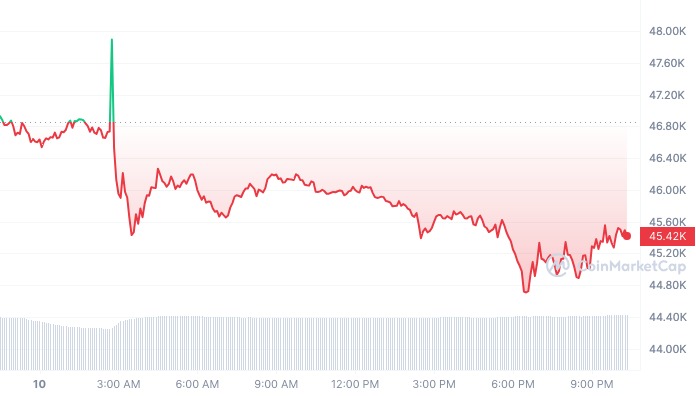

The ripple effect of the tweet was immediate and significant, with Bitcoin’s price responding to the supposed regulatory nod. SEC Chair Gary Gensler’s prompt action to clarify the misinformation helped quell the chaos, but not before the market experienced a whirlwind of activity.

Cybersecurity Questions and Market Sensitivities

This breach has raised critical questions about the security of official communication channels and the readiness of government agencies to prevent and respond to cyber threats. The market’s reaction to the event also underscores the delicate balance that exists between regulatory actions and crypto valuations.

Navigating the Misinformation Minefield

As the SEC works to correct the narrative and tighten its cybersecurity measures, the crypto market is left to navigate the aftermath. Investors and traders are now more aware than ever of the need for vigilance in an age where misinformation can spread at the speed of light.

Conclusion:

As we reflect on the aftermath of the ‘SEC Twitter Hack Impact,’ it becomes increasingly clear that the cryptocurrency investment landscape requires a blend of vigilance and patience. This incident not only underscores the necessity of obtaining verified information from official sources but also casts a light on the inherent volatility of digital currency markets, where a single tweet can lead to significant fluctuations.

Investors are reminded of the prudence required when navigating the digital finance realm, especially given the weight that unofficial reports can carry. It is a stark reminder that in the burgeoning stages of the crypto market, where infrastructures are still being tested, a cautious approach can be the key to weathering the storms of misinformation.

Ultimately, trust in the process and measured patience will be invaluable assets for participants in the crypto economy. As we move forward, it’s expected that this event will catalyze much-needed conversations around bolstering cybersecurity measures and enhancing the reliability of communication channels. By committing to these principles, the community can aim to safeguard against the turbulence of unverified news and maintain a steadfast course in the digital age.

This conclusion reinforces the message of caution and the importance of official confirmations, especially in response to sensitive information that could impact investment decisions. It also alludes to the broader questions the incident raises about market stability in the face of easily disseminated information.